Noah's risk management concept centers on five key features: Compliance, Comprehensiveness, Applicability, Timeliness and Completeness. The risk management team adheres to the aforesaid concept when managing risks, and strives to drive the company's rapid and rational growth upon the premise of proper risk management.

Through operation and collaboration at five levels, Noah ensures that risks at each product line stay well within control, that risk information of each sub-business and implementation status and results of risk measure are reported promptly, and that risk management suggestions and resource assurance measures are effectively communicated, thereby guaranteeing the earnest and substantive implementation of risk management concept and specific risk measures.

- Risk Control Committee

- Risk Management Center

- Compliance Management Center

- Subsidiary Risk Management Committee

- Subsidiary/Business Segment/ Risk Management Department and Compliance Management Department/Position

1. Members: Chairman, Gopher CIO, CPO and CRO of the group and senior managers of the investment sector.

2. Meetings are held on a weekly basis to review and assess the risk factors, sales formulas and pricing of all products.

3. Listen to the risk factors at the business level and operation & management level of each subsidiary, and perform an overall risk assessment.

4. All committee members are collectively involved in discussions to formulate instructional advice and fundamental opinions on the overall risks.

1. The Risk Management Center is comprised of the Product Risk Management Department, Overall Risk Management Department, Internal Control and Operational Risk Management Department and the risk management divisions of all subsidiaries. The Risk Management Center is responsible for the management and coordination of product risk, overall risk, internal control and operational risk at the group level given the functions of its subordinate departments;

2. The risk management divisions of subsidiaries monitor, assess, and manage their respective business risks.

1. Risk management meetings are held each week to identify and report on business operation and management risks in subsidiaries, decide on risk mitigation measures and implement the instructional advice from the group’s Risk Management Committee.

2. Perform regular audits of subsidiaries to identify and deal with risk factors in different business segments.

1. Major subsidiaries and business segments shall set up their risk and compliance management department or risk and compliance management positions.

2. Participate in the management of the whole business process, pre-event approval, mid-event management and post-event assessment.

1. Establish company-wide BCM teams to assist key business lines and departments in business impact and risk analysis.

2. Release the Business Continuity Management System and develop relevant plans for key tasks, covering our overall emergency response process and the disruption of business operations in vital systems and vital workplaces.

3. In 2021, Noah performed data backups and recovery drills for 15 key systems with the support of Information Security Department, which ensures the availability of backup data. The NGTS core business system underwent high availability tests before launch to ensure the disaster recovery ability of key systems. Emergency response plans for the database and K8S platform were created and tested in multiple scenarios, which improved the emergency response and recovery capabilities of the basic operation and maintenance team. In addition, the disaster resilience of the iNoah system has been tested by an annual disaster recovery drill.

This drill covered emergency measures to be taken, hardware and software resources to be used, and emergency procedures to be taken by all business departments/units when dealing with changes to our business process due to workplace closures caused by pandemic outbreaks. For instance, how we could switch to telecommuting and ensure employee health and HR availability to prevent disruption to business functions. The results of this drill are included in the Noah Pandemic Contingency Plan, which serves as a reference for our employees when faced with emergencies.

We have also implemented telecommuting solutions in response to the pandemic. To ensure our network information security and the best protection for our business, Noah Business Security Center has developed security requirements for telecommuting employees while granting them VPN access to our internal network resources. Using these methods, we have maintained "business as usual".

Thanks to this immediate response to business demand through digital services and technological reform, Noah's 2020 development was unimpeded by the pandemic, and nearly all of our transaction processes were moved online. Throughout the year, online client marketing programs and video meetings with investors significantly outnumbered their offline equivalents. Despite juggling the pandemic with organizational reforms, Noah delivered a brilliant performance in 2020.

For this reason, we have decided to invest 3-5% of our annual revenue into our technological and digital capacity. This strategic investment will be used to realize digital process management on different channels and deliver professional offline investment and consulting services; digitize product screening, investment & research, and continuity; and develop standard workflows, improve self-service ordering, and differentiate the online experience for our clients.

Adapting to the pandemic, Noah held the Wealth Management Leaders Virtual Summit in August 2020, the theme of which was “Finding Value, Riding Trends”. The event registered 2.5 million views and 10,678 users, attracting 1 million clicks across the network.

Noah's risk management concept centers on five key features: Compliance, Comprehensiveness, Applicability, Timeliness and Completeness. The risk management team adheres to the aforesaid concept when managing risks, and strives to drive the company's rapid and rational growth upon the premise of proper risk management.

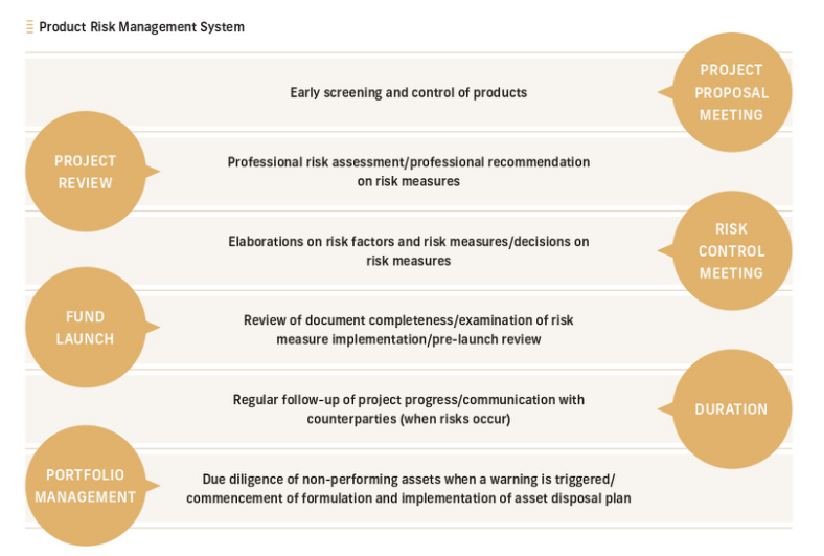

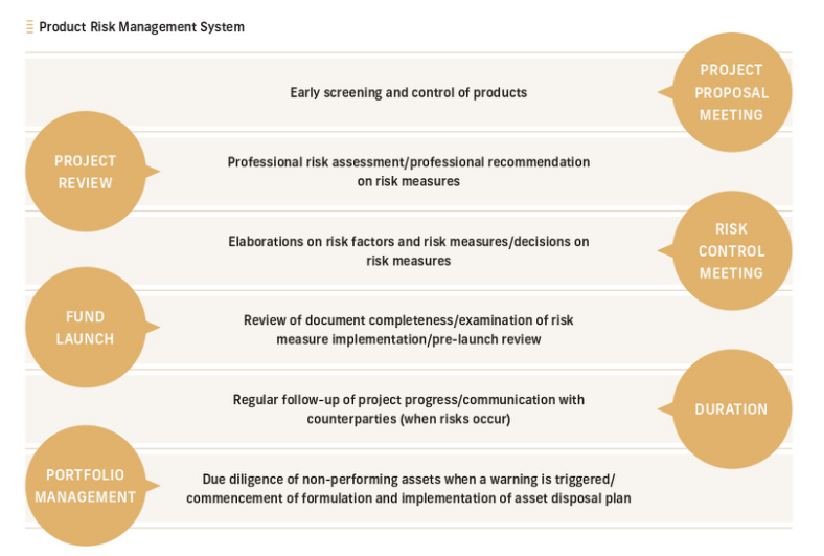

The Risk Management Center of Noah Group is involved in the entire financial product process, performing risk management function at each step. The Company has introduced industry-leading risk management technologies to quantify risks across all business lines and consolidate these at corporate level, and has developed risk quantification and assessment models suitable for different scenarios, implementing exposure limit management, key risk monitoring and risk mitigation. The Company defines risk factors in strict accordance with each product’s features, and undertakes exposure limit management using quantitative statistics. Meanwhile, we use risk management technology to assess the capital allocation of the company, establish appropriate economic capital allocation model, effectively manage product risk, protect the rights and interests of clients and the Company, and effectively use the Company's resources to improve efficiency.

Through operation and collaboration at five levels, Noah ensures that risks at each product line stay well within control, that risk information of each sub-business and implementation status and results of risk measure are reported promptly, and that risk management suggestions and resource assurance measures are effectively communicated, thereby guaranteeing the earnest and substantive implementation of risk management concept and specific risk measures.

1. Members: Chairman, Gopher CIO, CPO and CRO of the group and senior managers of the investment sector.

2. Meetings are held on a weekly basis to review and assess the risk factors, sales formulas and pricing of all products.

3. Listen to the risk factors at the business level and operation & management level of each subsidiary, and perform an overall risk assessment.

4. All committee members are collectively involved in discussions to formulate instructional advice and fundamental opinions on the overall risks.

1. The Risk Management Center is comprised of the Product Risk Management Department, Overall Risk Management Department, Internal Control and Operational Risk Management Department and the risk management divisions of all subsidiaries. The Risk Management Center is responsible for the management and coordination of product risk, overall risk, internal control and operational risk at the group level given the functions of its subordinate departments;

2. The risk management divisions of subsidiaries monitor, assess, and manage their respective business risks.

The Compliance Management Center is in charge of supervision, communication and coordination. Specifically, it supervises the interpretation of regulations and relevant training, the establishment of internal compliance systems and mechanisms, the compliance of products and investment management processes, the compliance of sales materials and processes, behavioral compliance, and regulatory deterrence. The role of the center is to ensure the compliant development and operation of our businesses.

1. Risk management meetings are held each week to identify and report on business operation and management risks in subsidiaries, decide on risk mitigation measures and implement the instructional advice from the group’s Risk Management Committee.

2. Perform regular audits of subsidiaries to identify and deal with risk factors in different business segments.

1. Major subsidiaries and business segments shall set up their risk and compliance management department or risk and compliance management positions.

2. Participate in the management of the whole business process, pre-event approval, mid-event management and post-event assessment.

1. Establish company-wide BCM teams to assist key business lines and departments in business impact and risk analysis.

2. Release the Business Continuity Management System and develop relevant plans for key tasks, covering our overall emergency response process and the disruption of business operations in vital systems and vital workplaces.

3. In 2021, Noah performed data backups and recovery drills for 15 key systems with the support of Information Security Department, which ensures the availability of backup data. The NGTS core business system underwent high availability tests before launch to ensure the disaster recovery ability of key systems. Emergency response plans for the database and K8S platform were created and tested in multiple scenarios, which improved the emergency response and recovery capabilities of the basic operation and maintenance team. In addition, the disaster resilience of the iNoah system has been tested by an annual disaster recovery drill.

We have also implemented telecommuting solutions in response to the pandemic. To ensure our network information security and the best protection for our business, Noah Business Security Center has developed security requirements for telecommuting employees while granting them VPN access to our internal network resources. Using these methods, we have maintained "business as usual".

Thanks to this immediate response to business demand through digital services and technological reform, Noah's 2020 development was unimpeded by the pandemic, and nearly all of our transaction processes were moved online. Throughout the year, online client marketing programs and video meetings with investors significantly outnumbered their offline equivalents. Despite juggling the pandemic with organizational reforms, Noah delivered a brilliant performance in 2020.

For this reason, we have decided to invest 3-5% of our annual revenue into our technological and digital capacity. This strategic investment will be used to realize digital process management on different channels and deliver professional offline investment and consulting services; digitize product screening, investment & research, and continuity; and develop standard workflows, improve self-service ordering, and differentiate the online experience for our clients.

Adapting to the pandemic, Noah held the Wealth Management Leaders Virtual Summit in August 2020, the theme of which was “Finding Value, Riding Trends”. The event registered 2.5 million views and 10,678 users, attracting 1 million clicks across the network.

Noah’s operating model has a high dependence on technological services. To enhance the resilience of our technological infrastructure and technological services in the face of natural hazard uncertainties and support our business continuity, we have formulated corresponding management processes, aiming at reducing the negative impact of potential disasters on our operations. The processes also contribute to sustainable operation and sustainable client service. To reduce the impact of the COVID-19 pandemic, our technology department facilitated an active shift to online workspace and online transaction to ensure our operation continuity.

Thanks to the continuous efforts of the technology department, the role of electronic transaction has been on a constant rise. As of December 2021, 98% of account registration, 99.99% of public fund trading, and 99% of private fund trading were completed online.