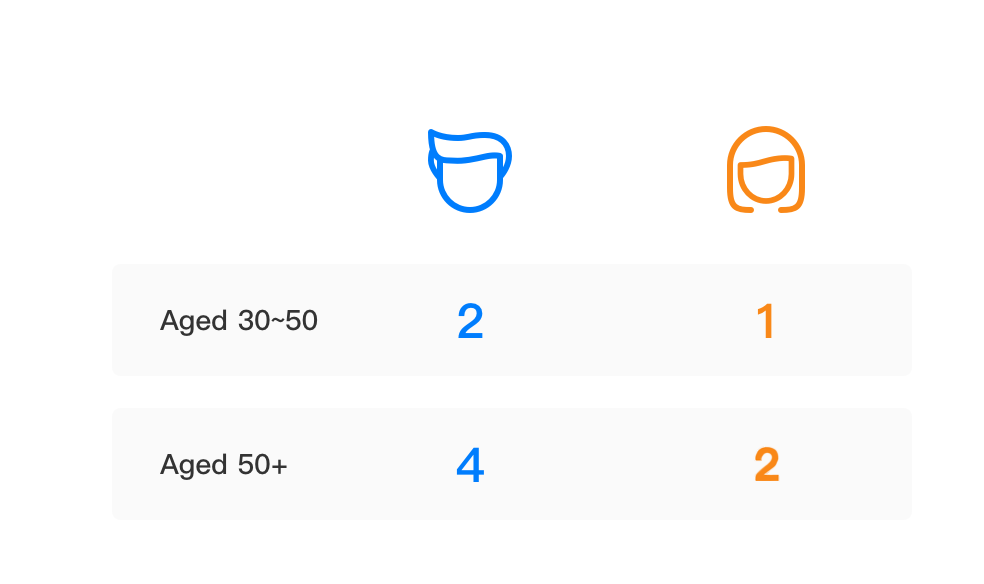

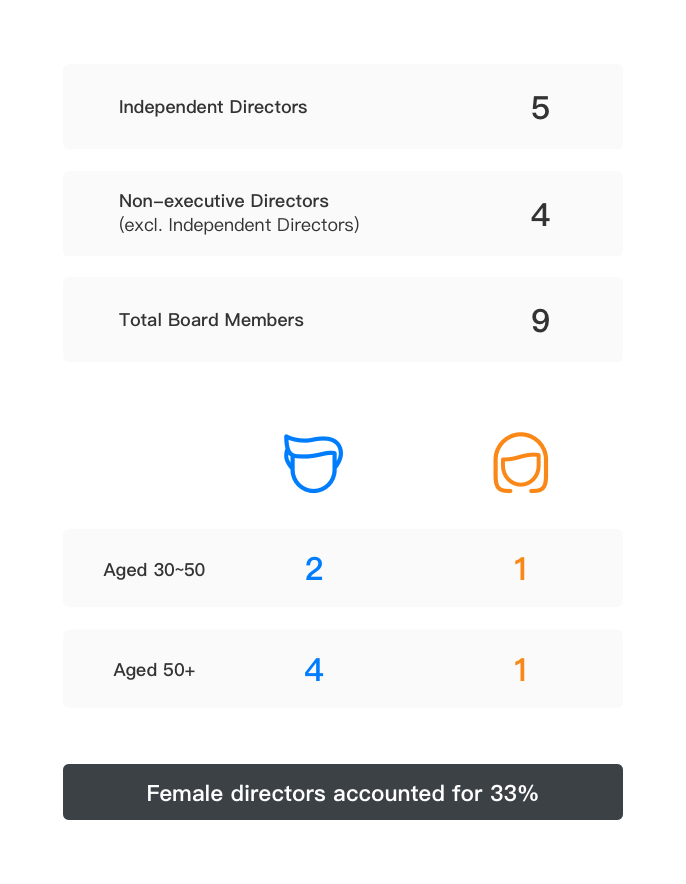

Noah works to build a diverse board encompassing a wide variety of backgrounds (including gender, age, and nationality) and cultural experiences, as well as expertise, skills, and experiences. All members of Noah’s Board of Directors were selected and nominated by the Corporate Governance and Nominating Committee. The Board mainly consists of industry professionals with financial backgrounds and skills.

The nine members of the Board all have experience in risk management.

Founded in 2003, Noah Holdings (NYSE: NOAH) was successfully listed on the New York Stock Exchange on November 10, 2010,

as the first independent wealth management organization to go public from mainland China. Noah’s corporate governance

system follows U.S. Securities and Exchange Commission (SEC) regulations.

The Board of Directors plays an active role in managing and promoting Noah’s sustainable development. Guiding Noah towards

its vision of Sustainability, the board must review and approve the group's strategies and goals in this respect.

Board of Directors

The Board contains nine Directors ( three being female Board Directors, accounting for 33%), and their average tenure is 11.3 years. The five independent directors constitute over half of the Board (55.6%), supervising the Board’s effective operation and providing objective and professional advice on the Group’s business operation. In 2021, Noah held four quarterly board meetings (attended by 100% of directors each time), one special board meeting, four audit committee meetings, one remuneration committee meeting, and one shareholder meeting.

The shareholder meeting allowed all shareholders, Board Directors and stakeholders to thoroughly discuss Noah’s major business matters, which effectively improved our operating performance. In addition, the Noah ESG Committee gave a special report to the Board of Directors.

The shareholder meeting allowed all shareholders, Board Directors and stakeholders to thoroughly discuss Noah’s major business matters, which effectively improved our operating performance. In addition, the Noah ESG Committee gave a special report to the Board of Directors.

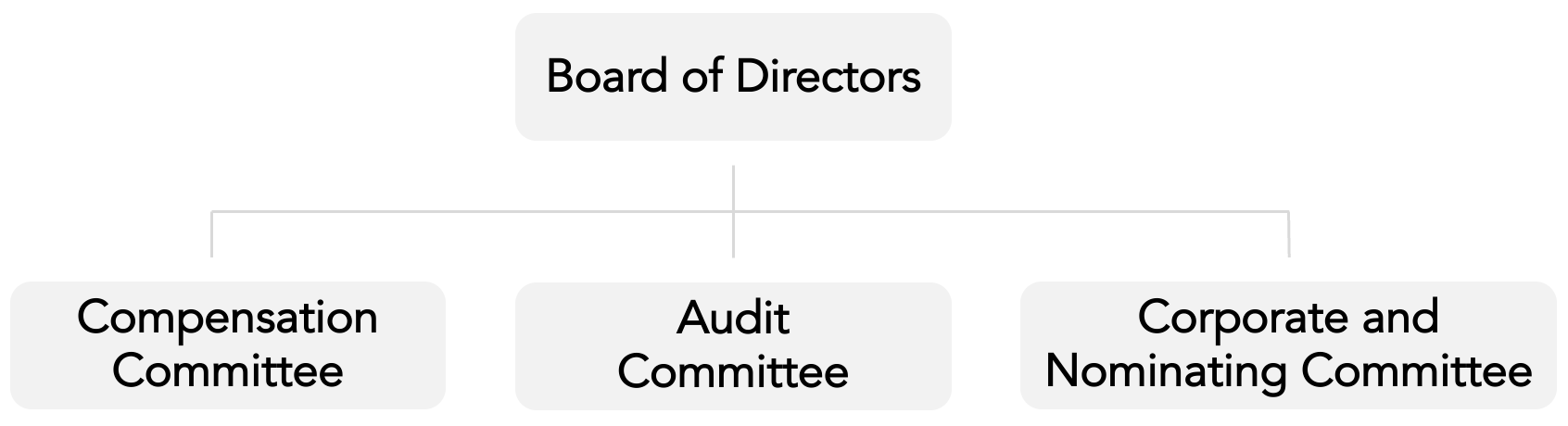

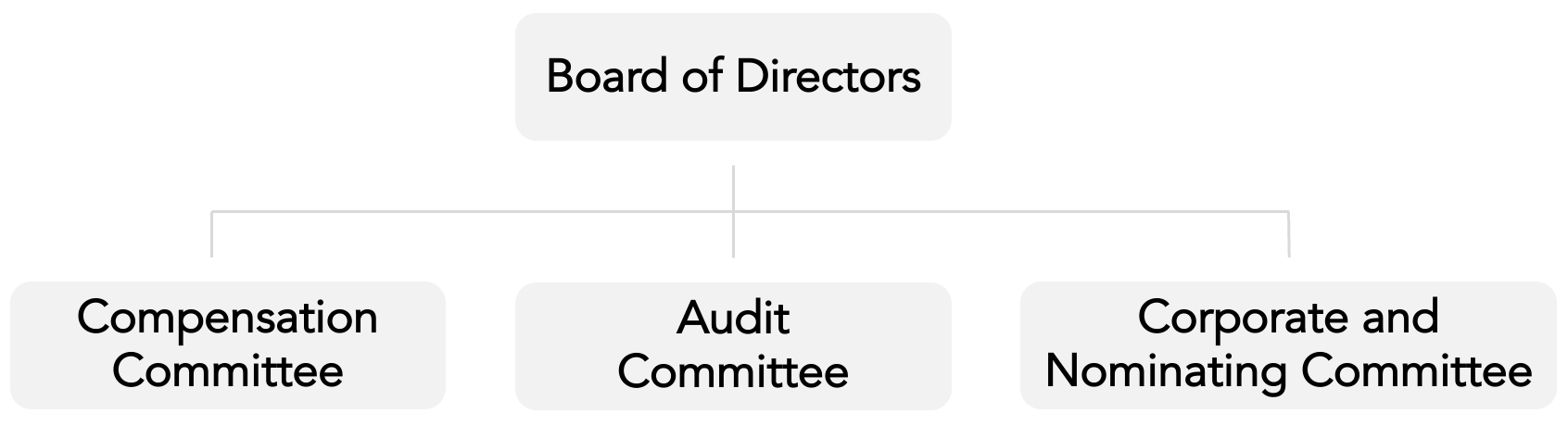

Board Structure

As an operational decision-making body, the Board of Directors oversees the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee, all of which are chaired by independent directors. As per the regulations of the Securities and Exchange Commission (SEC), independent non-executive directors constitute over half of the board (5/9), which increases the Board’s transparency and efficiency.

>The average tenure of Audit Committee members is 8.62 years. The tenures of our independent directors are as follows: Tze-Kaing Yang (6.67 years), May Yihong Wu (11.17 years), and Zhi Wu Chen (8.00 years).

Members of the Board of Directors are appointed by the Corporate Governance and Nominating Committee, most of which are industry professionals with financial backgrounds and expertise. See Noah’s Annual Report for the details of our board members:

http://ir.noahgroup.com/financial-information/annual-reports

The Board of Directors conducts a self-evaluation of its performance each year. This encompasses the directors’ involvement in business operations, board constitution and structure, board culture, management of material issues (including ESG issues), decision-making, and tracking. The 2021 self-evaluation of all Directors was conducted in 100% compliance with corporate governance requirements.

>The average tenure of Audit Committee members is 8.62 years. The tenures of our independent directors are as follows: Tze-Kaing Yang (6.67 years), May Yihong Wu (11.17 years), and Zhi Wu Chen (8.00 years).

Members of the Board of Directors are appointed by the Corporate Governance and Nominating Committee, most of which are industry professionals with financial backgrounds and expertise. See Noah’s Annual Report for the details of our board members:

http://ir.noahgroup.com/financial-information/annual-reports

The Board of Directors conducts a self-evaluation of its performance each year. This encompasses the directors’ involvement in business operations, board constitution and structure, board culture, management of material issues (including ESG issues), decision-making, and tracking. The 2021 self-evaluation of all Directors was conducted in 100% compliance with corporate governance requirements.

Name

Compensation Committee

Audit Committee

Corporate and Nominating Committee

Ms. Jingbo Wang

Mr. Zhe Yin

Ms. Chia-Yue Chang

Mr. Neil Nanpeng Shen

Mr. Boquan He

Member

Ms. May Yihong Wu

Chairwoman

Member

Member

Professor Zhiwu Chen

Member

Member

Mr. Jinbo Yao

Member

Mr. Tze-Kaing Yang

Member

Chairman

*Board of Directors: http://ir.noahgroup.com/corporate-governance/board-of-directors

*Leadership: http://www.noahgroup.com/about/team

*Leadership: http://www.noahgroup.com/about/team

Title

Name

Education

Experience

Chairwoman of the Board of Directors

Chief Executive Officer

Chief Executive Officer

Jingbo Wang

Master of Management and Bachelor of Economics, Sichuan University

Chairwoman of the Board of Directors and CEO, Noah Holdings

General Manager of Private Banking Department, Xiangcai Securities

General Manager of Private Banking Department, Xiangcai Securities

Director

Zhe Yin

Bachelor of Economics, Shanghai University of Finance and Economics; Master of Business Administration, China Europe International Business School

Chairman, Gopher Asset Management

Independent Director, Guizhou Xinbang Pharmaceutical Co., Ltd (002390.SZ)

Director, Tianyu Digital Technology (Dalian) Group Co., Ltd. (002354.SZ)

Independent Director, Guizhou Xinbang Pharmaceutical Co., Ltd (002390.SZ)

Director, Tianyu Digital Technology (Dalian) Group Co., Ltd. (002354.SZ)

Director

Frances Chia-Yue Chang

Bachelor of Library Science, National University of Taiwan; Master of Library Science, University of California, Los Angeles

Executive Director and Chairwoman of Noah ESG Committee, Noah Holdings

Former Chief Marketing Officer, Noah Holdings

General Manager, Noah Upright Fund Distribution

Former Chief Marketing Officer, Noah Holdings

General Manager, Noah Upright Fund Distribution

Director

Neil Shen

Bachelor of Applied Mathematics, Shanghai Jiao Tong University; Master’s degree, Yale University

Founding and Managing Partner, Sequoia Capital China

Co-founder, Ctrip.com and Home Inns.

Independent Director

Boquan He

Guangdong Television Public University

Founder and Chairman, Guangdong Nowaday Investment

CEO, Robust Group

CEO, Robust Group

Independent Director

May Yihong Wu

Bachelor’s degree, Fudan University; Master’s degree, Brooklyn College, City University of New York; MBA

MBA, J.L. Kellogg Graduate School of Management at Northwestern University

Independent Director and Chairwoman of the Audit Committee, Swire Properties

Chief Strategy Officer, Home Inns

Chief Strategy Officer, Home Inns

Independent Director

Tze-Kaing Yang

Master of Business Administration, University of Illinois at Urbana-Champaign; Doctor of Business Administration, National Chengchi University in Taiwan

Chairman and CEO, Yangtze Associates, Taiwan-based venture capital and private equity fund management company

Political Deputy Minister of the Ministry of Finance in Taiwan

Acting Chairman of Bank of Taiwan

Managing Director of Bank of Taiwan and President of China Development Industrial Bank

Executive Secretary of National Development Fund of Taiwan

Independent Director

Jinbo Yao

Double Bachelor of Computer Science and Chemistry, Ocean University of China

Founder, Chairman of the Board of Directors and CEO, 58.com Inc.

CEO, Ganji.com; Co-founder, Xueda Education Group

CEO, Ganji.com; Co-founder, Xueda Education Group

Independent Director

ZhiWu Chen

Bachelor of Computer Science, Central-South University Master of Systems Engineering, Changsha Institute of Technology; Doctor of Financial Economics, Yale University

Professor, Director of Asia Global Institute, Chair Professor of Finance, and Victor and William Fung Professor in Economics at the University of Hong Kong

Special-Term Visiting Professor at Peking University (School of Economics) and Tsinghua University (School of Social Sciences and School of Economics and Management)

Member, International Advisory Board of the China Securities Regulatory Commission

Special-Term Visiting Professor at Peking University (School of Economics) and Tsinghua University (School of Social Sciences and School of Economics and Management)

Member, International Advisory Board of the China Securities Regulatory Commission

Title

Name

Field

Asset Management

Responsible Investment

Sustainability

Risk Management

Expertise / Skills

Accounting

Law

Information Security

Audit

Chairwoman of the Board of Directors

Chief Executive Officer

Chief Executive Officer

Jingbo Wang

√

√

√

√

√

√

√

√

Director

Zhe Yin

√

√

√

√

√

√

√

√

Director

Frances Chia-Yue Chang

√

√

√

√

√

√

√

√

Director

Neil Shen

√

√

√

√

√

√

√

√

Independent Director

Boquan He

√

√

√

√

√

√

√

√

Independent Director

May Yihong Wu

√

√

√

√

√

√

√

√

Independent Director

Tze-Kaing Yang

√

√

√

√

√

√

√

√

Independent Director

Jinbo Yao

√

√

√

√

√

√

√

√

Independent Director

Zhi Wu Chen

√

√

√

√

√

√

As for equity structure, Jing Investors Co., Ltd. (100% held by Ms. Jingbo Wang’s family trust) and Yin Investment Co., Ltd. (100% held by Mr. Zhe Yin’s family trust) hold Class B shares, each of which carries four times the voting right of a Class A share.

All major related-party transactions are disclosed in the company’s annual report. Each year, board members are asked if they work in any other capacity within the industry, or serve on the Board of Directors. This serves to safeguard the rights and benefits of shareholders and stakeholders.

All major related-party transactions are disclosed in the company’s annual report. Each year, board members are asked if they work in any other capacity within the industry, or serve on the Board of Directors. This serves to safeguard the rights and benefits of shareholders and stakeholders.

Performance Evaluation and Remuneration of Directors

Weight

Item

Indicators

70%

Operation and development goals

ROA, RONA, DOE, and ROIC

30%

Internal management goals

Execution of corporate strategies, management of the Company and its subsidiaries, and indicators of sustainable development

Senior management personnel are entitled to equity incentives which will be vested and awarded over 4 years. In the case of any senior management’s conduct is inconsistent with our corporate values or damaging to corporate interests during

the vesting period, the Company has the right to cancel any outstanding equity incentives.

Founded in 2003, Noah Holdings (NYSE: NOAH) was successfully listed on the New York Stock Exchange on November 10, 2010,

as the first independent wealth management organization to go public from mainland China. Noah’s corporate governance

system follows U.S. Securities and Exchange Commission (SEC) regulations.

The Board of Directors plays an active role in managing and promoting Noah’s sustainable development. Guiding Noah towards its vision of Sustainability, the board must review and approve the group's strategies and goals in this respect.

The Board of Directors plays an active role in managing and promoting Noah’s sustainable development. Guiding Noah towards its vision of Sustainability, the board must review and approve the group's strategies and goals in this respect.

Board of Directors

Noah works to build a diverse board encompassing a wide variety of backgrounds (including gender, age, and nationality) and cultural experiences, as well as expertise, skills, and experiences. All members of Noah’s Board of Directors were selected and nominated by the Corporate Governance and Nominating Committee. The Board mainly consists of industry professionals with financial backgrounds and skills.

The nine members of the Board all have experience in risk management.

The Board contains nine Directors ( three being female Board Directors, accounting for 33%), and their average tenure is 11.3 years. The five independent directors constitute over half of the Board (55.6%), supervising the Board’s effective operation and providing objective and professional advice on the Group’s business operation. In 2021, Noah held four quarterly board meetings (attended by 100% of directors each time), one special board meeting, four audit committee meetings, one remuneration committee meeting, and one shareholder meeting.

The shareholder meeting allowed all shareholders, Board Directors and stakeholders to thoroughly discuss Noah’s major business matters, which effectively improved our operating performance. In addition, the Noah ESG Committee gave a special report to the Board of Directors.

The nine members of the Board all have experience in risk management.

The Board contains nine Directors ( three being female Board Directors, accounting for 33%), and their average tenure is 11.3 years. The five independent directors constitute over half of the Board (55.6%), supervising the Board’s effective operation and providing objective and professional advice on the Group’s business operation. In 2021, Noah held four quarterly board meetings (attended by 100% of directors each time), one special board meeting, four audit committee meetings, one remuneration committee meeting, and one shareholder meeting.

The shareholder meeting allowed all shareholders, Board Directors and stakeholders to thoroughly discuss Noah’s major business matters, which effectively improved our operating performance. In addition, the Noah ESG Committee gave a special report to the Board of Directors.

Board Structure

As an operational decision-making body, the Board of Directors oversees the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee, all of which are chaired by independent directors. As per the regulations of the Securities and Exchange Commission (SEC), independent non-executive directors constitute over half of the board (5/9), which increases the Board’s transparency and efficiency.

>The average tenure of Audit Committee members is 8.62 years. The tenures of our independent directors are as follows: Tze-Kaing Yang (6.67 years), May Yihong Wu (11.17 years), and Zhi Wu Chen (8.00 years).

Members of the Board of Directors are appointed by the Corporate Governance and Nominating Committee, most of which are industry professionals with financial backgrounds and expertise. See Noah’s Annual Report for the details of our board members:

http://ir.noahgroup.com/financial-information/annual-reports

The Board of Directors conducts a self-evaluation of its performance each year. This encompasses the directors’ involvement in business operations, board constitution and structure, board culture, management of material issues (including ESG issues), decision-making, and tracking. The 2021 self-evaluation of all Directors was conducted in 100% compliance with corporate governance requirements.

>The average tenure of Audit Committee members is 8.62 years. The tenures of our independent directors are as follows: Tze-Kaing Yang (6.67 years), May Yihong Wu (11.17 years), and Zhi Wu Chen (8.00 years).

Members of the Board of Directors are appointed by the Corporate Governance and Nominating Committee, most of which are industry professionals with financial backgrounds and expertise. See Noah’s Annual Report for the details of our board members:

http://ir.noahgroup.com/financial-information/annual-reports

The Board of Directors conducts a self-evaluation of its performance each year. This encompasses the directors’ involvement in business operations, board constitution and structure, board culture, management of material issues (including ESG issues), decision-making, and tracking. The 2021 self-evaluation of all Directors was conducted in 100% compliance with corporate governance requirements.

For more information on our ownership structure, please refer to the annual public disclosures.

About the Board Members

Performance Evaluation and Remuneration of Directors

Noah’s Board performs annual self-assessment, which KPIs included engagement in corporate operations, Board composition and structure, Board culture, management of major topics, decision-making and monitoring, with a maximum score of 43. In 2019, Directors’

average self-assessment score was 42,

In terms of management remuneration, Noah’s management team sets annual objectives and review criterias based on our corporate operating strategy and annual operating plan. These work objectives include:

In terms of management remuneration, Noah’s management team sets annual objectives and review criterias based on our corporate operating strategy and annual operating plan. These work objectives include:

Weight

Project(s)

Indicator Content

70%

Operational Development Objectives

Return on assets, return on net assets, return on equity , return on capital

30%

Internal Management Objectives

Promotion and execution of overall Group Strategy; and overall management of the Company and its subsidiaries