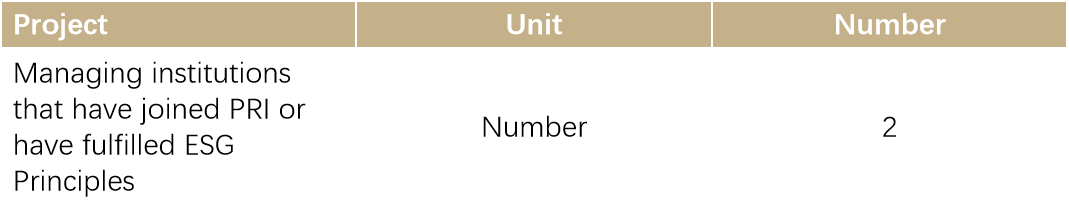

Noah: https://www.unpri.org/signatory-directory/noah-holdings-limited/5737.article

Gopher: https://www.unpri.org/signatory-directory/gopher-asset-management/5738.article

“One Goal, Two Concepts and Three Actions” as Gopher's Responsible investment Guidelines in 2022

2.Actively and responsibly participate in the development of new economic sectors and social progress as an institutional investor.

2.Proactive implementation: Ensure the coverage of proactive implementation for Gopher’s direct investment capabilities, which is one of Gopher’s long-term commitments, parallel to Gopher’s FOF investment capabilities. Actively implement ESG factors in the investment process and follow up with the long-term value of ESG factors in portfolio management process.

3.Ecosystem construction: Draw on Gopher’s private equity investment ecosystem and investor ecosystem to actively conduct client and GP surveys, as well as carry out activities under impact investing alliance, in an effort to promote the concepts and value of ESG responsible investment.

Established in January 2021, Gopher's independent investment research department added ESG considerations into its industry and company research modules, and emphasized on a group-wide sufficient understanding of ESG investing. Systematic PRI methodologies and screening criteria have been factored in to set out Gopher's PRI strategies and embed them in investment practices.

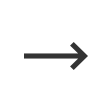

Led by Chairman Yin, Gopher's Responsible Investment Taskforce is comprised of front-, mid- and backend investment departments, with all members being key personnels within Gopher's investment team. In recent years, as Gopher's previous focus of investment in Hong Kong (SAR) and foreign areas has begun to extend to Mainland China, to ensure responsible investment, around 20 employees were allocated to form the Investment Research Department. From information collection to the establishment of standards and the formation of institutions and systems, responsible investment has become a centric part of Gopher's values and philosophy.

1. Research: ESG constitutes one of the industry's and the Company's research modules; research professionals develop their awareness of responsible investment; and departments formulate systematic theories and selection criteria for responsible investment, which ultimately combine into Gopher's responsible investment strategy;

2. Product: Embodiment of ESG elements in product design. Contemplate how to improve the ecological and financial environments, as well as capital efficiency through sustainable development and investment, so as to truly promote wealth and capital for the common good. The Hong Kong product team is developing an income fund product for responsible investment;

3. Screening system and investment portfolio: Inclusion of ESG contents in due diligence;

4. Brand Promotion:

(1) With regard to investor education, the ESG concept is advocated during different interactions with clients, while at the same time clients are encouraged and persuaded to personally partake in ESG investment;

(2) In terms of communication with supervisory bodies, we clearly express that Noah and Gopher value and practice the ESG concept, and their willingness and sense of responsibility in spreading the ESG concept among the GPs of subsidiaries.

1. Integrate ESG standards into our selection of relationship managers and fund managers

2. Educate investors via Enoch Education, the Human Resources Development and Training Department’s investor education segment and the Noah Charity Foundation, and drive sustainable socio-economic development by supporting social progress and poverty reduction.

3. Launch of sustainable finance within the public securities ESG section https://esg.noahgroup.com/article.html?id=84

In June 2021, we introduced ESG sections on Fund Smile and iNoah to encourage individual investors to fulfill social responsibilities and share the benefits of sustainable development with the community while pursuing investment returns.

• Incorporate ESG investment risk metrics when evaluating investment targets

• Undertake thematic investments (alternative energy, ESG-based selection, infrastructure fund, low-carbon investment)

• Periodic review of the ESG exclusion lists

• Annual review of domestic and foreign portfolio credit issuers using ESG checklist

• Ensure shareholder activism and prudently assess companies in which we invest

• Refrain from making additional investments in companies placed on the exclusion list due to violation of ESG and sustainable development principles

• Draw on the ESG checklist to confirm ESG implementation annually

• Require fully authorized institutions to provide ESG implementation documents

• Communicate with relevant stakeholder groups and promote principles and methods related to responsible investment

• Sent stakeholder letters to GPs and CEOs of the companies invested to raise awareness on climate risks

• Communicate our achievements in responsible investment to the public through annual sustainability reports

-

4th International Forum on Corporate Social Responsibility of Industry and Information Technology, 4th China International Import Exposition (CIIE)

The 2020 Noah Sustainability Report received an AAA rating at the forum for its sustainability concepts, material issues, clarity and completeness, objectivity and balance, expression, and design, which made Noah the only private financial service provider to win the highest rating. As a representative of model enterprises, Ms. Frances Chia-Yue Chang, Founding Investor and Executive Director of Noah Holdings, signed the Sustainable Development Initiatives for Industry and Information Technology Companies at the forum, expressing Noah’s commitment to championing and advancing the 2030 Agenda for Sustainable Development of the United Nations.

-

China Social Investment Forum: Risks and Opportunities related to Climate Change for Financial Institutions

On July 13, 2021, Frances Chia-Yue Chang attended the 2021 China Social Investment Forum Summer Summit organized by China SIF and gave a keynote presentation titled ESG Investing Under the Carbon Neutrality Goal, exchanging ideas and discussing trending topics with experts at home and abroad, such as policy breakthroughs and market development opportunities amid the current transition to a low-carbon economy and how institutions shall cope with such changes, and scientific assessment and proper response to physical risks and transformation risks.

-

Duke Kunshan University x World Economic Forum: Unlocking data-powered green growth

On June 18, 2021, Ms. Frances Chia-Yue Chang attended The Futures of Digital Economy and Investing Forum on Unlocking Data-Powered Green Growth organized by Duke Kunshan University under the support of the World Economic Forum. In the ESG symposium, Ms. Chang exchanged opinions with world-class financial experts on global ESG trends and the importance of ESG in promoting the sustainable development of businesses, society and the environment. Well-known experts, researchers, corporate executives, and financial elites at home and abroad jointly focused on the role of digital innovation in green development and discussed the future of ESG investing.

-

Caixin Media China ESG30 Forum Two Sessions Special Meeting: Green, Low-carbon, and Circular Development under the Carbon Neutrality Goal

On March 12, 2021, Caixin Media convened the China ESG30 Forum Two Sessions Special Meeting: Green, Low-carbon, and Circular Development under the Carbon Neutrality Goal. During the Develop Green Finance and Drive Green, Low-carbon Development section, Ms. Frances Chia-Yue Chang discussed with the leaders and guests attending the forum on the challenges and opportunities of financial institutions in guiding the low-carbon transition of society and the business community under the carbon peaking and carbon neutrality vision and exchanged ideas on ESG investing trends in China and the world under the carbon neutrality commitment.

-

Cailian Press ESG Summit Forum

On October 19, 2021, Noah received Best ESG Case of Chinese Enterprises in 2021 at the Cailian Press ESG Summit Forum and Prize Giving Ceremony for industry-leading exemplary performance in environmental, social and governance aspects. In addition, Noah was included in the 2021 Chinese Enterprises ESG Cases Whitepaper jointly released by Cailian Press and SynTao to guide the ESG practice of other enterprises.

Noah:https://www.unpri.org/signatory-directory/noah-holdings-limited/5737.article

Gopher:https://www.unpri.org/signatory-directory/gopher-asset-management/5738.article

2.Actively and responsibly participate in the development of new economic sectors and social progress as an institutional investor.

2.Proactive implementation: Ensure the coverage of proactive implementation for Gopher’s direct investment capabilities, which is one of Gopher’s long-term commitments, parallel to Gopher’s FOF investment capabilities. Actively implement ESG factors in the investment process and follow up with the long-term value of ESG factors in portfolio management process.

3.Ecosystem construction: Draw on Gopher’s private equity investment ecosystem and investor ecosystem to actively conduct client and GP surveys, as well as carry out activities under impact investing alliance, in an effort to promote the concepts and value of ESG responsible investment.

Established in January 2021, Gopher’s independent investment research department added ESG considerations into its industry and company research modules, and emphasized on a group-wide sufficient understanding of ESG investing. Systematic PRI methodologies and screening criteria have been factored in to set out Gopher’s PRI strategies and embed them in investment practices.

Led by Chairman Yin, Gopher’s Responsible Investment Taskforce is comprised of front-, mid- and backend investment departments, with all members being key personnels within Gopher’s investment team. In recent years, as Gopher’s previous focus of investment in Hong Kong (SAR) and foreign areas has begun to extend to Mainland China, to ensure responsible investment, around 20 employees were allocated to form the Investment Research Department. From information collection to the establishment of standards and the formation of institutions and systems, responsible investment has become a centric part of Gopher’s values and philosophy.

1. Research: ESG constitutes one of the industry’s and the Company’s research modules; research professionals develop their awareness of responsible investment; and departments formulate systematic theories and selection criteria for responsible investment, which ultimately combine into Gopher’s responsible investment strategy;

2. Product: Embodiment of ESG elements in product design. Contemplate how to improve the ecological and financial environments, as well as capital efficiency through sustainable development and investment, so as to truly promote wealth and capital for the common good. The Hong Kong product team is developing an income fund product for responsible investment;

3. Screening system and investment portfolio: Inclusion of ESG contents in due diligence;

4. Brand Promotion:

(1) With regard to investor education, the ESG concept is advocated during different interactions with clients, while at the same time clients are encouraged and persuaded to personally partake in ESG investment;

(2) In terms of communication with supervisory bodies, we clearly express that Noah and Gopher value and practice the ESG concept, and their willingness and sense of responsibility in spreading the ESG concept among the GPs of subsidiaries.

1. Integrate ESG standards into our selection of relationship managers and fund managers

2. Educate investors via Enoch Education, the Human Resources Development and Training Department’s investor education segment and the Noah Charity Foundation, and drive sustainable socio-economic development by supporting social progress and poverty reduction.

3. Launch of sustainable finance within the public securities ESG section https://esg.noahgroup.com/article.html?id=84

In June 2021, we introduced ESG sections on Fund Smile and iNoah to encourage individual investors to fulfill social responsibilities and share the benefits of sustainable development with the community while pursuing investment returns.

• Incorporate ESG investment risk metrics when evaluating investment targets

• Undertake thematic investments (alternative energy, ESG-based selection, infrastructure fund, low-carbon investment)

• Periodic review of the ESG exclusion lists

• Annual review of domestic and foreign portfolio credit issuers using ESG checklist

• Refrain from making additional investments in companies placed on the exclusion list due to violation of ESG and sustainable development principles

• Draw on the ESG checklist to confirm ESG implementation annually

• Require fully authorized institutions to provide ESG implementation documents

• Communicate with relevant stakeholder groups and promote principles and methods related to responsible investment

• Sent stakeholder letters to GPs and CEOs of the companies invested to raise awareness on climate risks

• Communicate our achievements in responsible investment to the public through annual sustainability reports

-

4th International Forum on Corporate Social Responsibility of Industry and Information Technology, 4th China International Import Exposition (CIIE)The 2020 Noah Sustainability Report received an AAA rating at the forum for its sustainability concepts, material issues, clarity and completeness, objectivity and balance, expression, and design, which made Noah the only private financial service provider to win the highest rating. As a representative of model enterprises, Ms. Frances Chia-Yue Chang, Founding Investor and Executive Director of Noah Holdings, signed the Sustainable Development Initiatives for Industry and Information Technology Companies at the forum, expressing Noah’s commitment to championing and advancing the 2030 Agenda for Sustainable Development of the United Nations.

-

China Social Investment Forum: Risks and Opportunities related to Climate Change for Financial InstitutionsOn July 13, 2021, Frances Chia-Yue Chang attended the 2021 China Social Investment Forum Summer Summit organized by China SIF and gave a keynote presentation titled ESG Investing Under the Carbon Neutrality Goal, exchanging ideas and discussing trending topics with experts at home and abroad, such as policy breakthroughs and market development opportunities amid the current transition to a low-carbon economy and how institutions shall cope with such changes, and scientific assessment and proper response to physical risks and transformation risks.

-

Duke Kunshan University x World Economic Forum: Unlocking data-powered green growthOn June 18, 2021, Ms. Frances Chia-Yue Chang attended The Futures of Digital Economy and Investing Forum on Unlocking Data-Powered Green Growth organized by Duke Kunshan University under the support of the World Economic Forum. In the ESG symposium, Ms. Chang exchanged opinions with world-class financial experts on global ESG trends and the importance of ESG in promoting the sustainable development of businesses, society and the environment. Well-known experts, researchers, corporate executives, and financial elites at home and abroad jointly focused on the role of digital innovation in green development and discussed the future of ESG investing.

-

Caixin Media China ESG30 Forum Two Sessions Special Meeting: Green, Low-carbon, and Circular Development under the Carbon Neutrality GoalOn March 12, 2021, Caixin Media convened the China ESG30 Forum Two Sessions Special Meeting: Green, Low-carbon, and Circular Development under the Carbon Neutrality Goal. During the Develop Green Finance and Drive Green, Low-carbon Development section, Ms. Frances Chia-Yue Chang discussed with the leaders and guests attending the forum on the challenges and opportunities of financial institutions in guiding the low-carbon transition of society and the business community under the carbon peaking and carbon neutrality vision and exchanged ideas on ESG investing trends in China and the world under the carbon neutrality commitment.

-

Cailian Press ESG Summit ForumOn October 19, 2021, Noah received Best ESG Case of Chinese Enterprises in 2021 at the Cailian Press ESG Summit Forum and Prize Giving Ceremony for industry-leading exemplary performance in environmental, social and governance aspects. In addition, Noah was included in the 2021 Chinese Enterprises ESG Cases Whitepaper jointly released by Cailian Press and SynTao to guide the ESG practice of other enterprises.